Due Diligence Checklist for Buying a Business

Buying a business can be one of the most rewarding ventures an entrepreneur can embark upon, yet it is also fraught with complexity and risk. Understanding the intricacies of the acquisition process and navigating them effectively is crucial for success. One of the most essential steps in this journey is completing a thorough due diligence checklist for buying a business.

What is Due Diligence?

Due diligence refers to the investigation and evaluation of a business prior to its acquisition. This comprehensive process allows potential buyers to assess risks, uncover liabilities, and validate the business’s value and financial position. The goal of due diligence is to gain a clear understanding of what you are purchasing and to ensure that there are no unpleasant surprises post-acquisition.

Why is Due Diligence Important?

Engaging in a detailed due diligence process serves several vital purposes:

- Risk Mitigation: Identify potential pitfalls and avoid making a poor investment.

- Validation: Confirm the seller's representations and ascertain the business's true value.

- Regulatory Compliance: Ensure that the business is compliant with all relevant laws and regulations.

- Negotiation Power: Arm yourself with information that can facilitate better deal terms.

Key Areas of Due Diligence

When conducting due diligence, there are several critical areas that you should focus on. Each contributes to a holistic understanding of the business you are considering acquiring. Here's a detailed breakdown:

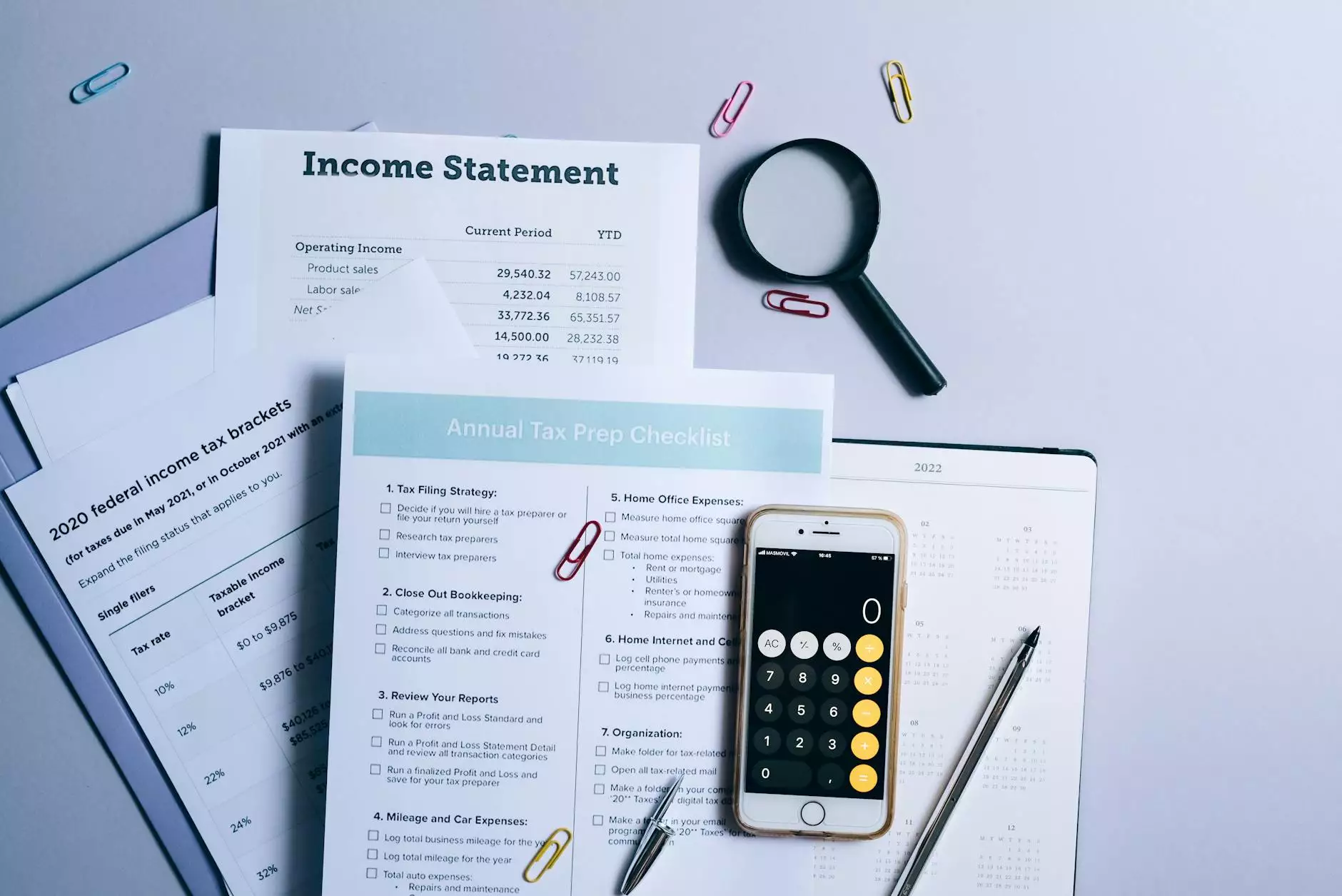

1. Financial Due Diligence

A firm's financial health is paramount in evaluating an acquisition. Key actions include:

- Reviewing the last three to five years of financial statements, including income statements, balance sheets, and cash flow statements.

- Examining accounting policies and practices to ensure consistency and accuracy.

- Understanding revenue streams, including customer concentration and sales trends.

- Analyzing outstanding debts and liabilities, including loans, leases, and other obligations.

2. Legal Due Diligence

Understanding the legal landscape of the business is crucial. Key aspects include:

- Reviewing all contracts, including supplier agreements, customer contracts, and employee agreements.

- Identifying any ongoing or previous litigations and their potential impact on the business.

- Checking for compliance with local, state, and federal regulations.

- Verifying intellectual property rights and any related registrations.

3. Operational Due Diligence

This area evaluates the efficiency and effectiveness of the business's operations:

- Assessing operational procedures and workflows.

- Evaluating the quality of the workforce, including key employees and their roles.

- Analyzing the supply chain and vendor relationships.

- Understanding the technology and infrastructure supporting the business.

4. Commercial Due Diligence

Understanding the market context in which the business operates is essential:

- Analyzing market trends, competitors, and customer demographics.

- Assessing the business’s market position and brand strength.

- Evaluating sales strategies and customer acquisition efforts.

- Conducting SWOT analysis (Strengths, Weaknesses, Opportunities, Threats).

5. Environmental Due Diligence

For many businesses, especially those in specific industries, environmental factors can pose significant risks:

- Reviewing compliance with environmental regulations.

- Identifying potential environmental liabilities, such as contamination or waste disposal issues.

- Understanding the implications of company operations on local ecosystems.

Steps in the Due Diligence Process

To effectively execute your due diligence checklist for buying a business, follow these systematic steps:

1. Prepare Your Due Diligence Checklist

Your checklist should be tailored to the specific business and industry you are evaluating. Here are some key components to include:

- Financial documents

- Legal contracts

- Corporate governance documents

- Operational reports

- Market analysis and competitors

2. Assemble a Due Diligence Team

Consider forming a team of professionals to assist with different areas of due diligence. This team may include:

- Accountants for financial review

- Lawyers for legal compliance

- Industry consultants for operational insights

3. Conduct the Investigation

Engage in systematic data collection and review. Schedule meetings with key personnel to understand various aspects of the business.

4. Analyze Findings

Once the data is gathered, analyze it to identify any red flags or areas of concern. Compare the findings against your expectations and the seller’s claims.

5. Prepare Due Diligence Report

Compile your findings into a due diligence report outlining critical areas of concern. This can help you strategize for negotiations and make informed decisions.

Common Pitfalls to Avoid

While conducting due diligence is essential, there are common pitfalls you must avoid:

- Insufficient Scope: Focusing only on financials can lead to overlooking operational or legal issues.

- Over-Reliance on Seller Information: Always verify claims made by the seller through independent sources.

- Neglecting Cultural Fit: Assess the cultural compatibility between your business and the one you intend to buy.

Conclusion

Completing a robust due diligence checklist for buying a business is an indispensable component of a successful acquisition strategy. From financial assessments to legal compliance checks, thorough due diligence aids in paving the way for informed decisions, ensuring that you make a sound investment. By following a structured process and taking a vigilant approach, you place yourself in a strong position to navigate the complexities of business acquisition successfully.

At openfair.co, we understand the intricacies involved in business acquisitions and can provide expert business consulting services to guide you through every step of the due diligence process. By partnering with us, you enhance your chances of making a successful and informed purchase, safeguarding your investment for the future.